by Deborah Kops, Sourcing Change

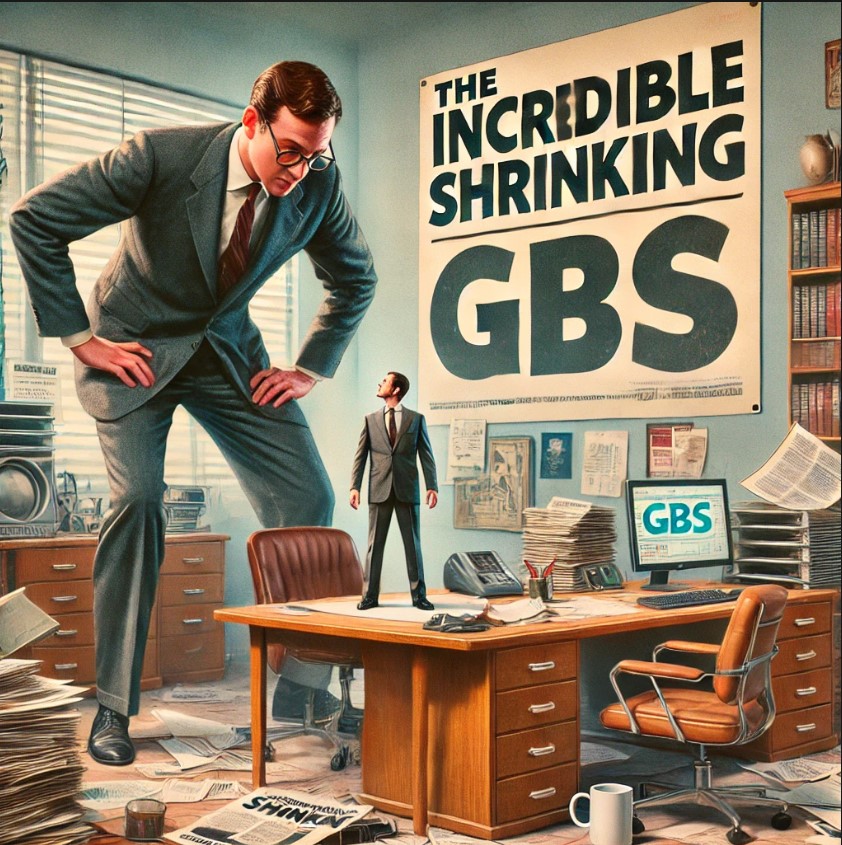

I’m not an aficionado of science fiction, but I dimly remember (and haven’t seen) a 1957 film called “The Incredible Shrinking Man.” The story follows Scott Carey, an ordinary man who is exposed to a mysterious radioactive mist while on vacation. Soon after, he begins to notice strange changes in his body: he is losing weight and height at an alarming rate. Medical professionals are unable to explain or reverse the condition, and as Scott continues to shrink, his life becomes a terrifying struggle for survival. The movie delves into Scott’s reflections on his humanity, his place in the universe, and the nature of his very existence.

Global business organizations grow, but they also shrink. Is The Incredible Shrinking Man a parable for the downside of GBS scale and scope?

You’re probably thinking I’ve lost it if I’m conflating GBS’s misfortunes to the plot of an old science fiction movie (some of you might believe that GBS is science fiction, but that’s for another article). Or even bringing the topic up. But the enterprise giveth and taketh; we all know that it’s the nature of the beast; GBS scale was never assumed to be static.

What we focus on in this industry is how to scale a GBS rather than the reality that they similarly shrink. We talk about bigger being better. More scope equals more leverage. More scope drives interoperability. More scope means that the enterprise must sit up and listen to us.

And that’s great, but unfortunately, both life and the model aren’t on a straight growth trajectory. So, if you believe forewarned is forearmed, it’s critical to understand the markers that indicate our organizations may lose height and weight, just like Scott Carey, at times at an alarming rate. It’s not just down to politics or bad luck. So, I set out to identify the markers that suggest a GBS will likely shrink …and what we might do about it.

What drives diminution?

- GBS viewed as a source of talent not an ecosystem Although we usually club GBS with optimal sourcing of talent, the value of the talent isn’t released without an integrated system of talent and capability. When the enterprise sees GBS merely as a talent pool, it may overlook the collaborative and strategic value GBS offers. This limited perspective can lead to underutilization of GBS capabilities, making it vulnerable to downsizing or reallocation of functions.

- GBS functionally aligned It’s a hard truth to swallow but hear me out: GBS organizations that are strictly functionally aligned—e.g., a consolidation of functional shared services —are ripe for the picking by their parent functions. It’s easy to lift and shift dedicated units back to HR or finance under the guise of better functional control and integration.

- Critical stakeholder(s) with deep GBS experience Think controller who formerly ran finance shared services. Or a supply chain leader who understands the power of end-to-end and thinks they are best placed to own the process lock, stock, and barrel. These folks tend to compare models and outcomes in their last gigs, sometimes believing that GBS in their current gig comes up short.

- Too much noise If GBS struggles to deliver consistent service quality, contribute cost savings, or drive innovation, the enterprise will lose confidence in the model. As a result, activities or even entire operations will be repatriated or even outsourced to third parties.

- Ineffective knowledge transfer/capture Migration to a GBS model can be risky business, leading to operational disruptions and loss of critical information. Because hypercritical eyes are focused on every little (and big) thing that does not go according to plan, the perceived value of the model is diminished. The enterprise becomes gun-shy, scaling back, slowing down or even stopping the transfer of scope, and branding GBS as a corporate misstep.

- ERP changing the enterprise world order If done well, an ERP implementation eliminates much of the work that GBS organizations perform, or at the very least, reduces the need to manage fragmented or manual processes.

- Stakeholder disengagement Misaligned expectations, lack of effective change management, and poor communication put a magnifying glass on GBS performance. When stakeholders become disengaged due to misaligned expectations, lack of communication, or perceived inefficiencies within GBS, they can withdraw their support, taking back processes or curtailing scope transfer. Support for the model is eroded.

- M&A activity During a merger or acquisition, the development of a new organizational construct can lead to the reevaluation of the GBS model. For some stakeholders that don’t endorse the model, it’s an opportunity for knives out. In the search for synergies, other options, such as outsourcing, repatriation, or a new target GBS operating model may be put on the table, resulting in GBS’s downsizing or dissolution.

How should GBS arm itself against shrinkage?

- Smart customization Every business wants to be treated as special; because the GBS value prop is standardization and harmonization, customer requirements or moments that matter are often deprioritized. Tailoring GBS services to meet the specific needs of different business units enhances relevance and value. It’s a GBS balancing act; addressing unique requirements while adhering to standardized solutions wherever possible does not necessarily compromise efficiency.

- Talent packaged with ecosystem It’s more difficult to pull apart a GBS when the unit of value is so much more than a smart worker. GBS organizations usually emphasize talent rather than packaging talent with an ecosystem that unleashes its value. Getting stakeholders to understand that the effective globalization of work requires packaged technology, management, and capabilities such as transition and change management (that no one else will invest in). There should be no white space between the two. Lifting and shifting out talent won’t deliver.

- Acceleration of end-to-end process implementation If GBS manages entire value chains rather than discrete functional or business processes, it’s much more difficult to pull functions or activities out or apart. This not only creates more efficiency and accountability and enhances service quality, but it can’t be replicated elsewhere in the enterprise.

- Effective stakeholder engagement Most of what we bandy around as stakeholder management is nothing but lip service, not true engagement (and stakeholders don’t want to be managed, anyway). GBS organizations that bite the bullet and actually invest in stakeholder engagement, a give-and-take process, will guard against shrinkage.

- Third-party provider integration When a provider’s activities are integrated into GBS operations, it becomes difficult to pull them out and have them report to a function or the business. A business aspiring to decimate GBS scope by changing the assignment of a contract will have to think twice before proceeding.

If you read this closely, you’ve probably noticed the use of guns, knives, and bullets. While I’m not an advocate of violence, sustaining or growing a GBS in the face of corporate politics and preferences, and light-speed changes in business conditions is a war of attrition. It’s best to ferret out root causes and apply antidotes in your battle plan.

But if you do lose a bit of height and weight, remember what goes around comes around. Be gracious and wait it out, remembering that:

- The business or function still needs your network and capabilities

- Only a delivery ecosystem unlocks the power of global talent; the rest of the enterprise does not specialize in operating a global ecosystem

- This, too, shall pass; GBS organizations bite the dust, then rise again like a phoenix